Dante & The Infernal Chip Shortage

Audinate CMO Joshua Rush updates us: how we got here; where we’re at; and what to expect.

Interview: Christopher Holder

When it comes to the chip shortage plaguing the AV industry a few names keep cropping up for special mention. One is Audinate. Its Dante chips are in thousands of impacted products that can be hard to get. Fairly or unfairly, Audinate’s apparent inability to fulfil orders is a real source of frustration for many. Commendably, Audinate got on the front foot and held a press conference at this year’s Infocomm show in June to explain some of the issues facing all AV manufacturers and some of the challenges particular to Audinate. I spoke to Audinate’s CMO, Joshua Rush, after the show to hear more.

AV: Thanks for making the time Joshua. What’s a nutshell of the supply chain problem from an Audinate perspective?

Joshua Rush: Essentially the shortage is a result of a combination of unprecedented demand for product combined with supply side issues such as factories closing down, covid restrictions on output, and shipping problems. So it’s a perfect storm of supply side constraints and the demand side which has been going through the roof.

Unfortunately, to ramp up supply to meet that demand takes time — anywhere between two to four years to get a new chip manufacturing plant online, for example. It’s not something the semiconductor companies could just flip a switch and produce more. That said, we’re hearing now that new capacity is coming online as a result of the initial crunch back in March of 2020. So that’s about how long it takes for demand to free up.

AV: With the chip shortage comes chip allocation. Which is fraught.

JR: That’s right, the chip companies went into allocation mode and the AV industry had to get in line — we’re minnows compared to other multi-billion-dollar multinationals.

One example, was the Xilinx Spartan-6 FPGA allocation in late 2021. It wasn’t specific to Audinate and it hit the AV industry particularly hard.

AV: How has Audinate responded?

JR: Prior to the supply chain issues we were already working on a next generation version of product, but it was still a couple of years out. So that Spartan-6 announcement caused us to accelerate the development of the next-gen Brooklyn 3 chip. Actually, it’s about to ship [as of the time of publishing]. We really fast tracked it. We took something that usually would have a two-year gestation and condensed it to one year. And so we’re in a much better position on that product.

Incidentally, we ended up going back to Xilinx and let them know the impact its decision was going to have on the industry. And we were actually able to get more allocations. So it went from initially looking like a pretty dire situation to improving quite dramatically by the beginning of 2022. We were able to fulfil orders we had on the books, not necessarily for ongoing demand, but at least to fulfil some of those orders.

AV: Tell us more about the demand for your product.

JR: As of the end of the fiscal year, at end of June, we shipped more of our chips, cards and modules than any other year in the history of the company. We supplied 816,000 units in FY22, up from 756,000 the year before.

AV: That might surprise a few people.

JR: Right. And it illustrates that this is both a supply and demand issue: our demand has never been higher, and supply is tight and lumpy. So that’s what creates that gap.

AV: How do you mean ‘lumpy’?

JR: In a normal year we would just have this steady trajectory, receiving orders and fulfilling/shipping orders. Instead, we’ve had a very lumpy year where we have periods of essentially little activity, especially towards the end of last calendar year, and then we’d get huge shipments of components, after which we’d frantically build our parts and ship them out to our customers. But there’s a lag there, and that’s frustrating for customers.

The situation with our Brooklyn and Broadway chips is getting smoother. Ultimo, which is our low channel count product, continues to be lumpy. We’re in constant negotiations with NXP, the supplier. They’ve been a great partner in terms of getting us allocation. But I’ll be the first to admit it’s way below the demand we have on that. So that’s the one right now that we’re actively working on negotiating, but also working on other solutions that don’t use that particular NXP part. It’s a mixed bag; it’s a journey; and I think we’re getting through it. But overall, the situation looks a lot better now than it did.

AV: What’s Audinate doing to insulate itself from the worst of something like this happening again?

JR: There are two main things we’re doing. One is diversification of the component portfolio, such as what we’re working on with the Ultimo chip, so we’re not as bound to one particular supplier. The other measure we’re taking is a move to software.

We launched Dante Embedded Platform about a year and a half ago now and we’ve got over 100 manufacturers evaluating it or in the process of rolling it out. It’s a shift that was underway well before covid came along or the supply chain crunch. Customers were thinking about moving to more off-the-shelf platforms, using software-based solutions and that development just accelerated as a result. At the Infocomm press conference we had TJ Adams from QSC as a guest speaker — QSC is a lead customer for Dante Embedded Platform and he talked about the rationale behind that and how it’s a factor behind why they’ve been successful throughout the pandemic, having made a migration to an off-the-shelf Intel architecture and using Dante Embedded Platform from Audinate.

AV: Moving from a hardware to a software business must be a significant shift for Audinate?

JR: It’s definitely a different business model. But it’s not foreign to us. Probably what’s most different with Dante Embedded Platform is working with customers to help to validate it in their designs. We’re not running our software on our own dedicated chip, in this instance, we’re sharing space with the manufacturer’s software. So our OEM support team is actively working with customers to work through that and make sure they get Dante performance out of the product.

AV: Sounds like coding for your own chip is way less hassle… but the market is demanding you move in this direction?

JR: I wouldn’t put it like that exactly. We’re actually excited about where this is headed. For example, something we’re actively promoting is the flexibility afforded by the Dante Embedded Platform. A product, like the K-Array amplifier we showed you at ISE, is now ‘Dante ready’. It means you can activate Dante if and when you need it, or you could upgrade the channel count for the duration of a weekend for a special event. With Dante as software, all of that is now possible.

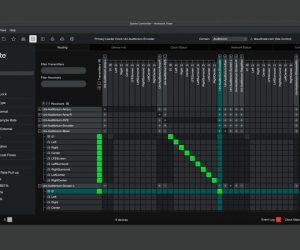

Our strategy over time is to provide more software and services that add value to the Dante networks. Dante Domain Manager is a great example of that, where we have software that allows people to monitor and manage their Dante networks. We’re currently in a beta for essentially a SAAS, cloud version. That’s a great example of another service we can offer to customers that helps improve their overall experience with Dante.

RESPONSES