Pro AV Market On Road To Recovery

How is global Pro AV poised to respond and recover in a post-pandemic world? Avixa’s Market Intelligence team runs a rule over the numbers.

This is an edited transcript of a Virtual ISE session ‘Emerging Trends’ with Sean Wargo (Senior Director Market Intelligence, AVIXA) and Peter Hansen (Economic Analyst, AVIXA).

Sean: We gain an understanding of the market through market research here at Avixa, starting with a macroeconomic perspective. We talk about the actual trends in AV and the biggest opportunities for growth, before digging into markets, where consider how to harvest and harness opportunities there.

Peter: Pro AV is exposed to an incredible diversity of sectors that ties our industry to the economy as a whole, including global GDP decline. But the good news is we’re turning that around! We’re seeing a recovery beyond the pre-pandemic level this year, thanks to 6% growth. The Americas is pretty similar to those overall trends. Asia-Pacific contracted last year, but is growing strongly this year and has a good, strong long-term outlook. EMEA is the weak point, 5.2% of GDP decline last year and that’s going to push out the recovery to pre-pandemic levels until 2022.

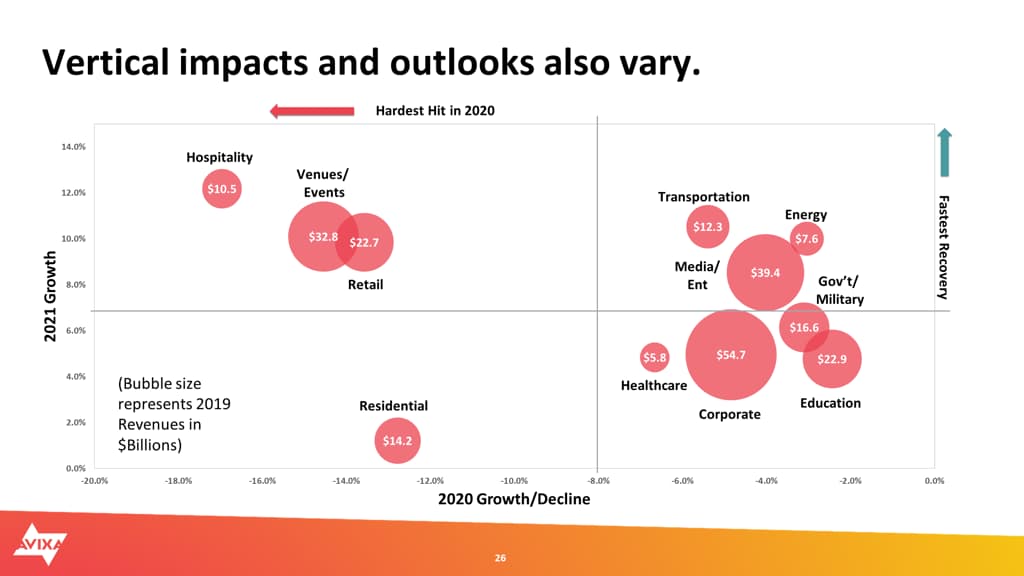

I want to highlight some of our meta macroeconomic trends in vertical markets.

Corporate

You’ve probably heard lots of doomsday scenarios along the lines of falling office rents and a decline in office construction, thanks to an increase in remote work. However, our analysis shows office construction actually stayed a little bit above declining. At the very least, declining less than it was leading into the pandemic. Not necessarily exceeding expectations, but the decline is in line with what we were noticing prior to the pandemic. The corporate sector is proving more robust than you might think, despite the move away from offices.

Retail

Retail is another vertical market that’s looking more robust, even bricks and mortar retail. It did hit a rough patch early in the pandemic, specifically bricks and mortar, but rebounded much quicker than a lot of people were expecting. We’re seeing positive sales and employment growth, even levels of growth that are similar to pre pandemic.

Pro AV Industry Numbers

Sean: Our market analysis suggest 2022 is the time we will start to see real growth for our industry. It’s worth noting that when you dig a large trough, as we did in the pandemic period and are returning to growth, it takes a while to return to what prior forecasts might have forecast for our industry during this time period.

So no, we won’t have to wait til 2025 for return to pre-pandemic growth estimates. The trends that are underlying this, though, are things that we’ve all been living with. We heard from Peter about GDP as an underlying ingredient for growth in our industry, but other things have been happening as well. Events have become virtualised. We have more content distribution. We’re investing in infrastructure that allows us to support this hybridisation of events.

The rate of recovery and the impacts have been very different market to market. Whether we’re talking The Americas, APAC or EMEA, you could say APAC ‘first hit first to recover’, but APAC has had the fits and starts of the recovery as well.

If we look at The Americas, for example, we see -8% revenue decline from 2019 to 2020, and then growing 5 – 6% percent for the next couple of years. APAC is experiencing a rapid recovery but not from as deep a hit (at -6% in 2020) but growing 9 – 7%. As we look at the next two years, EMEA is experiencing a more localised phenomenon, with 9% declines and then 5% rates of growth as we go forward.

AV Jobs

Peter: Employment and sales are both on the course to recovery. But one thing to keep in mind about employment is that its recovery is going to lag sales. Hiring a new worker is an investment, which means that companies always want to make sure they are seeing plenty of sales or revenue before they bring on new staff. And there’s actually more data that we’ve gotten recently telling us there’s some more hidden slack, and employment is going to lag even further.

In our research, people reported that their workload was lower than the previous winter. They also reported that the company’s staffing levels relative to work was higher. What that tells us is that these companies have more capacity to absorb more work without hiring new employees. That means there’s extra slack and employment is going to take a while to bounce back. You might think this would result in stagnant wage growth but ‘sticky wages’ means that salaries continue to rise even when the supply exceeds demand. And we saw that in the AV world in all of our regional groupings — salary increases between 2 – 3%. This is lower wage growth than reported prior to the pandemic. So there’s some impact, but there’s still growth, even though supply is exceeding demand in the labour market.

History Suggests

Peter: We asked this big question: ‘how does society respond in the aftermath of big crises?’ We looked at a lot of data, as well as major crises like the Spanish flu and the Great Depression. Do people get back to what they were doing before or do they retain the changes in behaviour from the crisis? And the data is really clear. The way people act in those crises is a product of the circumstances. They’re not fundamentally changed as people. So that means that all those wonderful things powered by AV, such as live events and amazing retail are going to be bounce back. There’s something there that can’t be recreated at home that people miss and we’re going to get back to when we feel safe.

Cause For Optimism

Sean: As you can tell, we are optimistic about the future for Pro AV. We see our industry returning to strength on the back of recovering GDP. As economies return, so too does Pro AV.

Our industry is diverse. We serve almost all aspects of an economy: retail, hospitality, venues, etc. What’s more, we’re geographically diverse and we are technology diverse. All those things allows us to adapt and continue to grow as an industry. It may be a challenge for companies to adapt and look for those areas of growth but a fundamental principle is that of experiences: technology being used to augment and enhance experiences across all of these various markets and geographies.

Technology is a key ingredient and it means Pro AV is well situated to continue to provide and be a part of that adaptation and recovery.

Avixa Market Intelligence: www.avixa.org/market-intelligence

RESPONSES