Avixa Market Report

Avixa’s much anticipated global market report has dropped. We take a look at some of the headline figures.

Text:/ Christopher Holder

Avixa engaged new market analysts this time around (IHS Markit) and the result is a global market report with more granularity and precision.

The press was provided with a headline figure package which I’m using here. If you’re an Avixa member you can buy the full report. I’ve not editorialised, just picked out some of what I think is interesting. So from here on I’ll be quoting the report:

LET’S TALK ASIA PAC

Against a generally sound pan-Asian economic backdrop, the AV market in the Asia-Pacific (APAC) will exhibit a compound anuujal growth rate (CAGR)v of five percent rising to around $84 billion through 2022. Although every Asian sub-region has contributed to the market’s growth and new value creation, there are differences in growth and pro-AV prospects, with the stnadout market being China (including Hong Kong and Taiwan). At around $34 billion in 2017, China currently accounts for nearly 53 percent of the industry’s value in Asia-Pacific, and through 2022, will comfortably retain a similar range of total industry spend.

The professional AV industry worldwide generated US$178 billion in 2016. Through 2022, it is expected that global AV revenues will increase 4.7 percent annually. The industry will create an additional US$52 billion in value over the remainder of the forecast period.

The APAC region generated US$63 billion in revenue in 2016 and will exhibit a solid CAGR of 5 percent through 2022.

“”

Services-led value creation reflects an AV industry — and broader technology ecosystem — whose complexity and technological sophistication is unprecedentedly high.

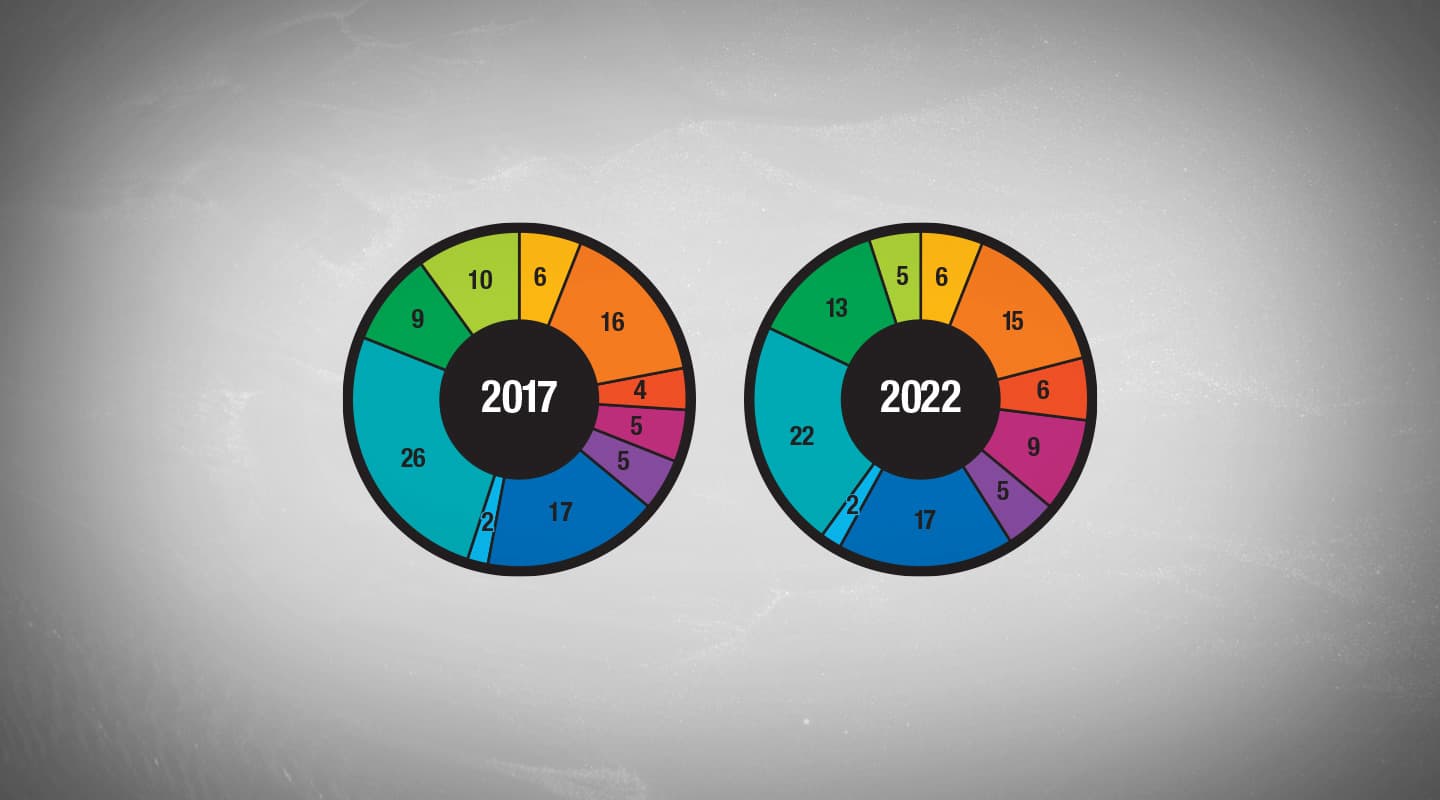

SEGMENT SLICING

I thought some of the segment by segment valuations were quite interesting:

Streaming media, storage, and distribution platforms (SMSD) generated $47.2 billion in 2016 (globally), and singlehandedly accounted for a quarter of the professional AV industry’s revenues.

While SMSD revenues vary regionally — local production and price competition for media storage in Asia will precipitate 2 percent value contraction per annum, 2016 through 2022 — the SMSD segment is a stable, dependable store of value for two overarching reasons. First, SMSD opportunities intertwine closely with display opportunities. Transportation, public space, retail, advertising, and enterprise investment in displays — or signage — generates considerable demand for media players and servers. Second, SMSD platforms’ storage elements protect organisations’ treasured AV assets, retain high intrinsic value as a consequence, and exhibit low elasticity of demand.

The display segment accounts for 8 percent of the industry’s revenues, but is growing at a 14 percent CAGR, will be worth $30 billion by 2022, and will account for 13 percent of industry spend by the conclusion of the forecast period.

Services-led value creation reflects an AV industry — and broader technology ecosystem — whose complexity and technological sophistication is unprecedentedly high. AV design, systems integration, and managed services demand is the product of an IT, data, and software-centrism that imposes new demands on skills and operational expertise. Services will generate $40 billion by 2022, and will account for 17 percent of spend as the second-largest segment of the pro-AV market.

Video projection is the lone segment to lose value over the remainder of the forecast period. In 2016, video projection generated nearly $22 billion, and constituted 12 percent of total pro-AV spend. By 2022, the segment will be worth $11 billion, and will have lost 50 percent of its value.

The segment’s value contraction is largely a function of technological evolution and increased adoption of flat-panel displays.

ABOUT IHS METHODOLOGY

In addition, many of the solution areas included in this study have been covered in detail from the buyer side, looking at contracts, installations and deployments globally for broadcast and media, command and control, corporate conferencing and collaboration, digital signage, military and governmental, retail, education and hospitality, and security surveillance. Again, IHS Markit has specialist teams looking at industries from the buyer side rather than the technology side, and that provided this report with additional detailed insight into the decision-making for diverse industries, from retail advertising to military simulations. Each of these industries utilizes a wide cross-section of technologies and services from the entire pro-AV supply chain, and this has been unpacked and aligned with total market drivers for the relevant product and service segments.

RESPONSES