APAC: The Rising Star of Pro AV

Our exclusive preview of InfoComm’s 2014 Asia-Pacific AV Market and Strategy Study.

Text:/ Jen Temm

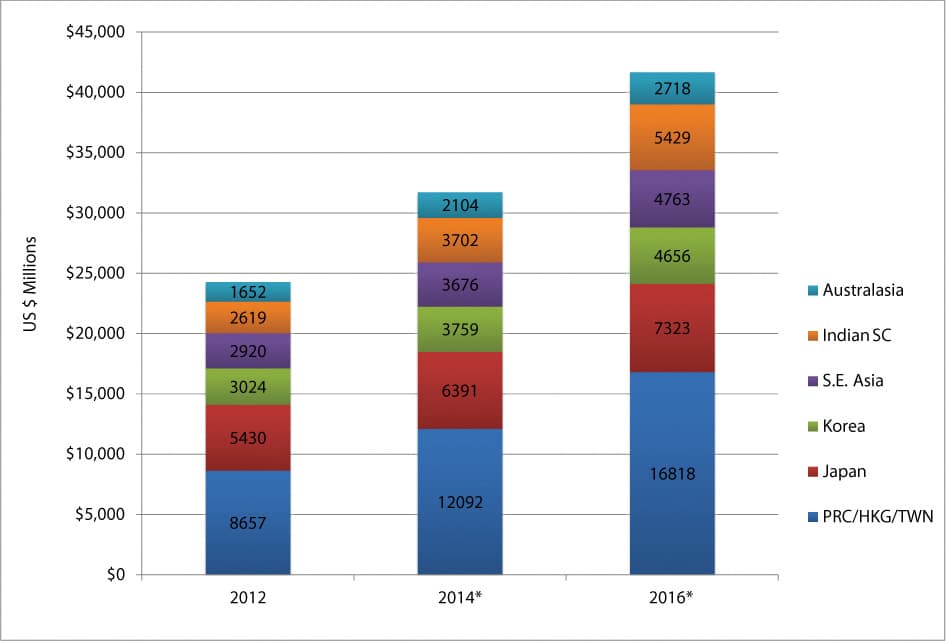

The Asia-Pacific region is leading the global AV market as the fastest growing region for the AV industry, with growth projected to rise by 15 percent to reach $41.6 billion by 2016 (all amounts are in US dollars).

The figures come from InfoComm’s 2014 Asia-Pacific Global Market Definition and Segmentation Study (MDSS), which offers a detailed picture of the current and future shape of the professional AV market with a comprehensive analysis of sales and customer statistics, regional trends and opportunities, the effects of global and local politics and economics, the impact of cheaper Asian manufacturing and more. It’s an essential tool for strategic business planning, and here we share some of its key findings.

THE BIG PICTURE

The global professional AV market has grown from $75.5 billion in 2012 to $91.8 billion this year, and is forecast to reach $114.2 billion in 2016. The industry was not impacted by the global financial crisis to the same degree as many other sectors of the economy thanks largely to emerging markets. And in a landmark shift, the Asia-Pacific region (APAC) is forecast to pass North America in 2016 and become the largest pro AV market in the world.

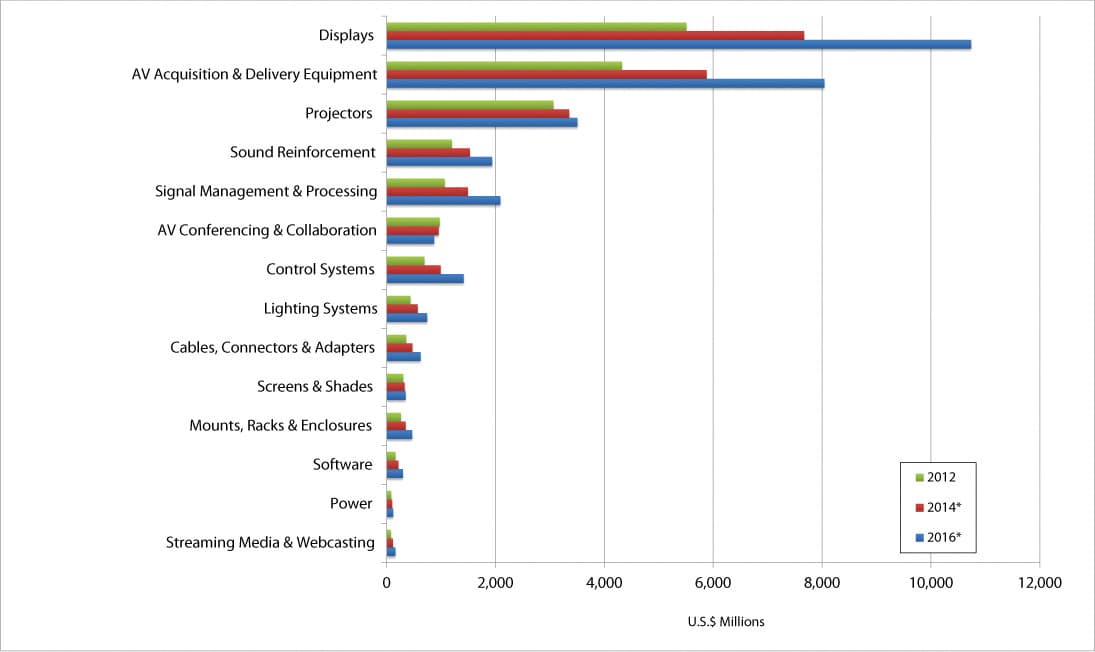

The fastest growing product categories are displays, AV acquisition and delivery, and projectors. The slowest growing are AV conferencing and collaboration, which is expected to remain stagnant for the next two years, and screens and shades. The transition to digital technology is driving sales in emerging markets where analogue remains prevalent, and digital signage is improving product sales in all regions. Video technology use continues to grow but the catalyst has been the development of previously unavailable low-cost, software-driven solutions. Today the trend is towards installing small solutions in smaller rooms at lower prices. The interest in adopting network-based AV solutions is growing, and selling complete solutions is perceived to be key to future growth as opposed to selling individual products.

APAC AV

Asia-Pacific (APAC) is the fastest growing and now the biggest region globally in terms of product sales, surpassing even North America (although North America is larger overall because of its higher services revenues). China has the largest market share in the region, and India’s pro AV market is growing slightly faster than China’s but from a smaller base. Advanced, mature markets – Japan, New Zealand, Australia, Hong Kong and Singapore – are experiencing slow but steady growth.

SOUTHEAST ASIA

The Southeast Asia pro AV market will grow from $2.9 billion in 2012 to $3.7 billion in 2014, and is expected to reach $4.8 billion by 2016. With the exception of Singapore, Southeast Asia is a region of developing and emerging markets. In most countries there is a substantial focus on price and keeping costs down, often resulting in poor quality solutions and margin-pressure. Tourism, however, is important throughout the region and as a result hospitality is a strong and growing sector. Education is also significant, especially for projector and screen vendors. In the corporate sector, multinationals offer the most opportunity as local companies have less interest in AV and are less willing to pay for AV solutions.

AUSTRALASIA

The MDSS found that Australia was very tech-savvy and leads the way in technology development and adoption, with a huge trend to communicating, collaborating and educating using video. The high cost of labour is also driving demand for wireless solutions, or other products or systems that help reduce the labour component of installations. Confidence in government affects investment levels, however, and the current government’s cutbacks on spending and programmes is impacting investment and spending in the private sector.

AV-as-a-service is a key trend, and service contracts are becoming a standard part of deals. A growing number of IT manufacturers, distributors and integrators are also increasing their focus on the AV market and becoming much more capable of delivering pro AV managed services solutions.

Relative to other regions of the world, adoption of unified communications is quite far along in Australia, with pro AV channels playing key roles in this development. The country’s national broadband network rollout is also creating a huge growth opportunity for unified communications and networked AV applications.

The digital signage market in Australia has developed substantially over recent years but there is a collective opinion that digital signage is a “confusing space” that is ill defined, with too many competing products from a wide range of manufacturers.

The New Zealand market is about one-tenth the size of the Australian market and largely mirrors it, although it is not doing as well as it was prior to the damaging Christchurch earthquake in 2011. Most of Australia’s larger pro AV manufacturers, distributors, integrators and designers are involved in the New Zealand market, often servicing it directly from Australia. With a lack of local distributors, New Zealand pro AV tends to have a leaner structure.

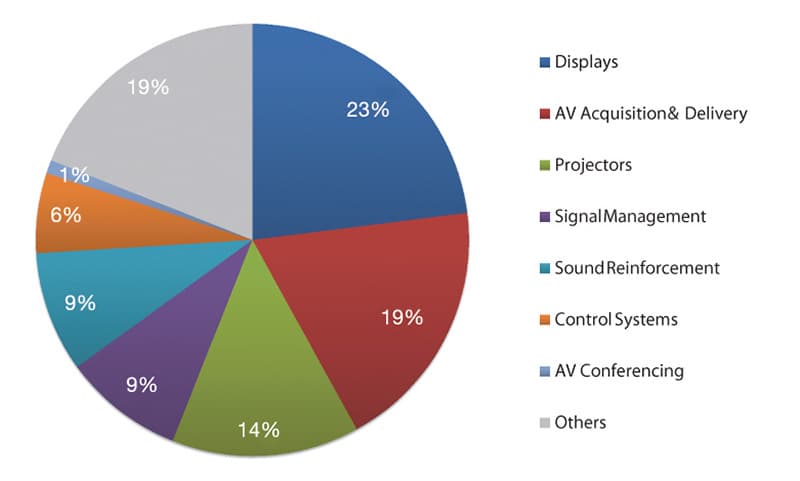

DOMINATING DISPLAYS

The three largest product segments in APAC – displays, AV acquisition and delivery equipment, and projectors – make up more than half the market this year. Streaming media and webcasting, control systems, displays and signal management, AV acquisition and delivery, and software are also growing quickly. The slowest growing segments are AV conferencing and collaboration, projectors, screens and shades,

and power.

Interesting product trends include a decline in conferencing and collaboration revenue despite increased demand, as it shifts from large, costly hardware-based equipment to more flexible and affordable software-driven solutions. Conferencing as a high-cost or complex installation is losing favour; simplification of use and cost are now key attributes.

The MDSS identifies HDBaseT as a significant trend that is expected to see strong growth over the next few years. While still too expensive for the mass market, it is a growth opportunity that goes hand-in-hand with the notion of content distribution over networks and the analogue sunset trend that is pervasive in the region.

Displays are the single largest product segment and the fastest growing, with sales expected to exceed $10 billion by 2016. Video walls in particular are gaining popularity, particularly in corporate, control room and medical markets, and there is growing interest from military and security organisations throughout Asia. There is a high level of interest in both 3D and interactive displays also but content is an issue – customers are still trying to figure out how to take advantage of these technologies.

ON-TREND

- Chinese manufacturers dominate their domestic market and are rapidly gaining ground at the low-end in price-conscious markets around the world – expect to see growing competition and better quality from Asian pro AV manufacturers in future, especially from China.

- APAC pro AV is becoming increasingly integrated with ICT, and IT managers and CIOs play a larger role in corporate technology investments. The key challenge for AV vendors is finding staff who understand both AV and IT, particularly as IT vendors add more AV capabilities.

- Almost every pro AV channel consulted expressed concern that the lack of awareness of pro AV across the region is hindering growth, and there is a need to educate the market about the advantages pro AV can deliver. Educating and training customers leads to tangible returns and the interest in training is ‘enormous’.

- Most APAC AV vendors are experiencing high staff turnovers, and the MDSS identifies a need for more and better training of AV staff. In short supply are sales and marketing people with technical skills, integrators with multiple skills sets, and design consultants.

The third edition of MDSS was produced by InfoComm International in cooperation with Acclaro Growth Partners. Data was gathered from manufacturers, distributors, service providers and industry organisations between December 2013 and May 2014. The Asia Pacific MDSS will be available for purchase shortly for US$2,250, and the Australian edition will be launched at Integrate 2014 in Sydney. Contact infocomm.org for more information.

WHO’S SPENDING?

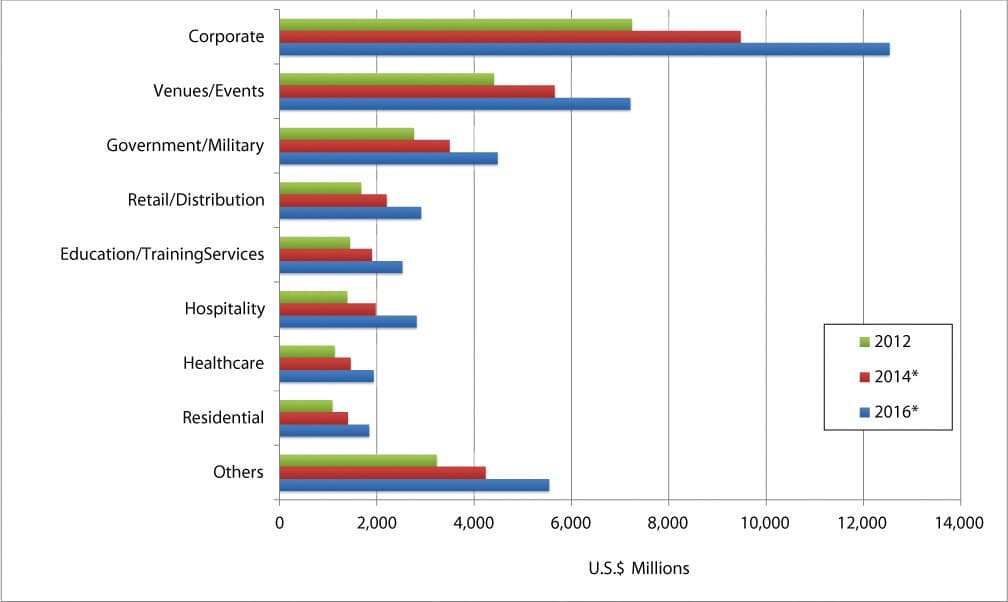

The corporate market dominates the APAC pro AV industry with almost one-third of total spending. One key driver, especially in the more mature markets, is a change of workspace organisation and the need for more conference and meeting rooms as well as conferencing solutions. Virtual training, room booking systems and command/control centres are also of growing interest to the corporate sector.

Education is also a fast growing sector as governments throughout the region spend to improve education, notably in New Zealand and China. There is growing interest in AV conferencing, particularly from Australian, Indian and Japanese universities who are investing heavily in AV with a significant replacement market.

RESPONSES